Following the Kofax Transform day 1 keynotes, we had a separate session for financial and industry analysts to be briefed on the products and financials.

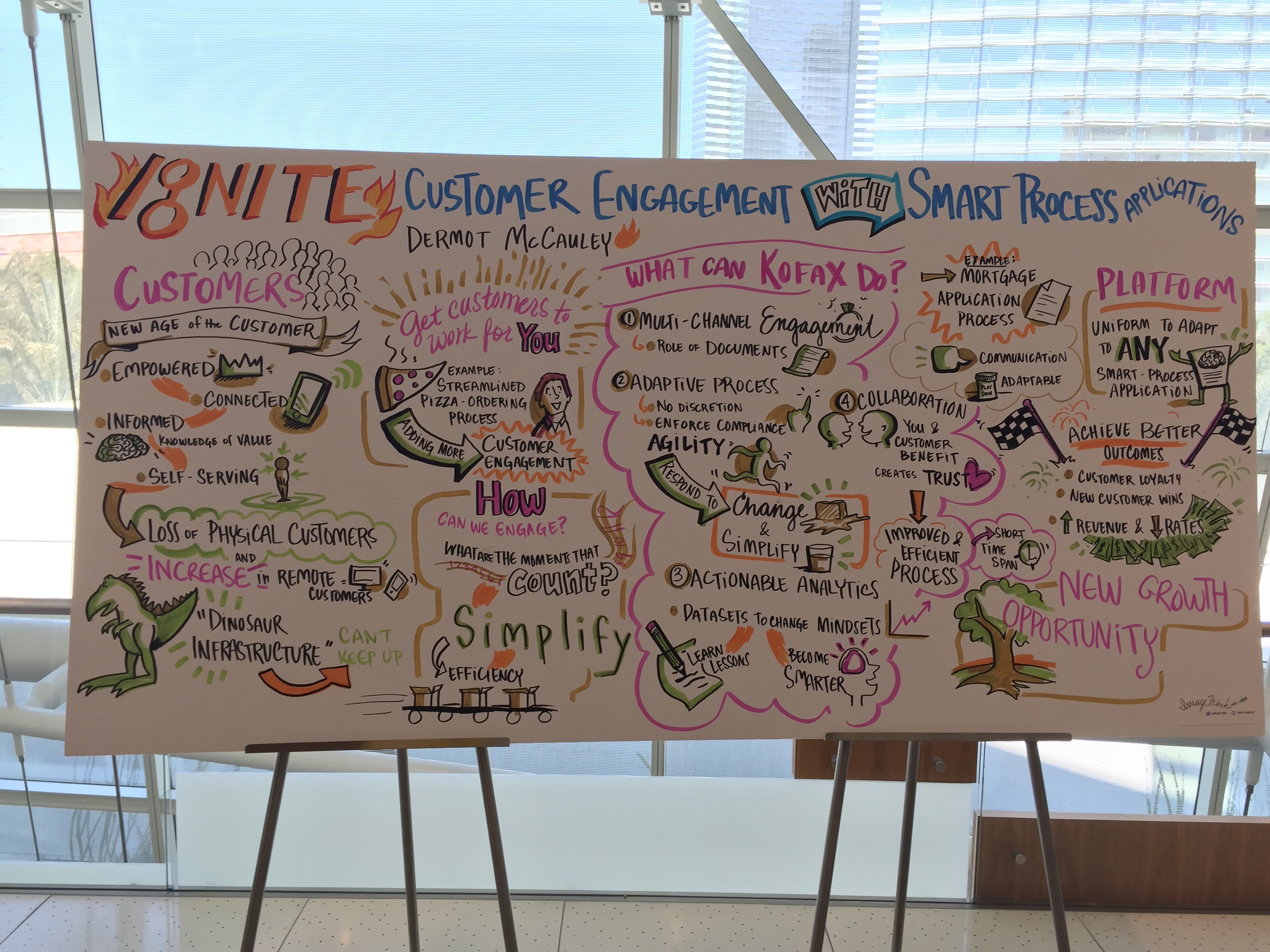

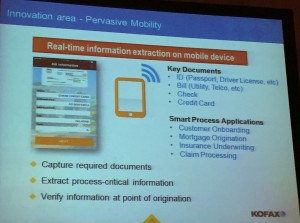

After a brief introduction from Reynolds Bish, we had a detailed briefing on the Kofax product portfolio from Anthony Macciola, the CTO, focusing on the themes of digital transaction management and the first mile of business. The first mile is driven by customer expectations, allowing business transactions to become conversations. Customer demands, however, are exceeding the capabilities of many organizations, in terms of business culture as well as systems of record. Interactions need to be simple, easy, quick and informative, and companies need to be able to reach out and collaborate with a customer as part of the process. This brought him to a discussion of the Softpro and Aia acquisitions, which provide e-signatures and outbound customer communications management, respectively. These both have the ability to be rebranded and can be fully integrated into Kofax TotalAgility (KTA) applications, meaning that they can be used to create touchpoints with customers that are seamless, personalized, and contain closed loop identifiers for efficient processing of paper correspondence.

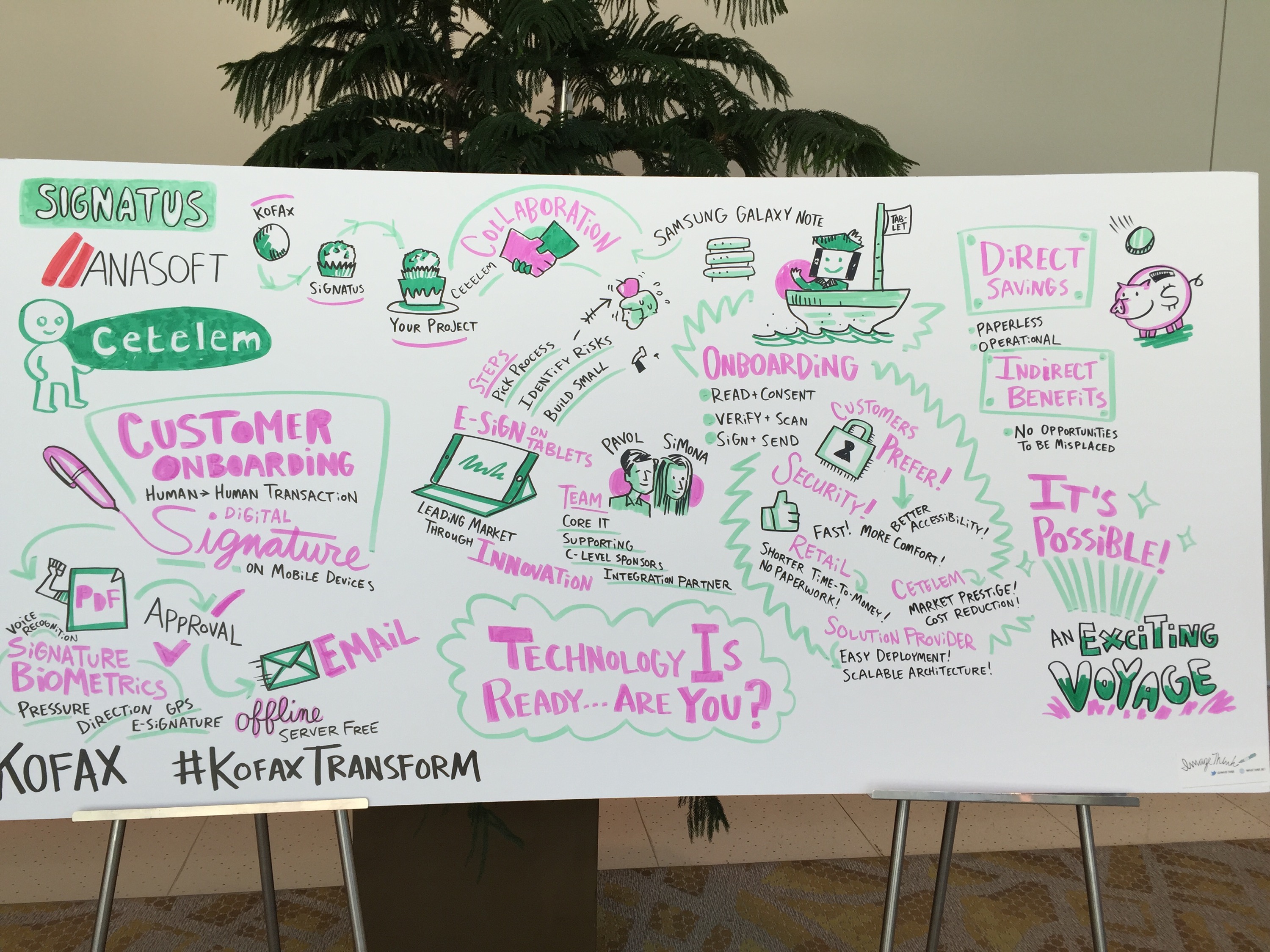

Outbound customer communications management provides a way to create outbound correspondence to customers by marrying configurable templates with customer-specific data fields — think of it as a super-sophisticated MS-Word mail merge. Macciola showed the Aia designer and how it is used to create reusable library assets such as headers, footers and body text using MS-Word for user familiarity and easy import from existing documents, then assemble those assets into templates. These can include closed loop identifiers such as bar code versions of customer and case IDs for rendering as printed documents that can be auto-rendezvoused with the case on their return, but it’s more interesting to look at the case of publishing as electronic documents with e-signature requirements embedded, including identifying and authenticating reviewers and signers, and orchestrating the “signing ceremony” process. These are pretty important additions to the Kofax portfolio for managing the first mile of customer engagement, where a customer needs to sign and return documents related to an account or transaction: the customer can choose to print and sign the document (or receive a printed document in the first place), then return it for scanning and rendezvous, or they can choose to sign it electronically in a secure environment that creates a PDF file that includes the signature plus audit trail information. Electronic signatures can be done as a written signature using a tablet (with finger or stylus), or with the customer keying in their name or other phrase in place of their signature, once authenticated.

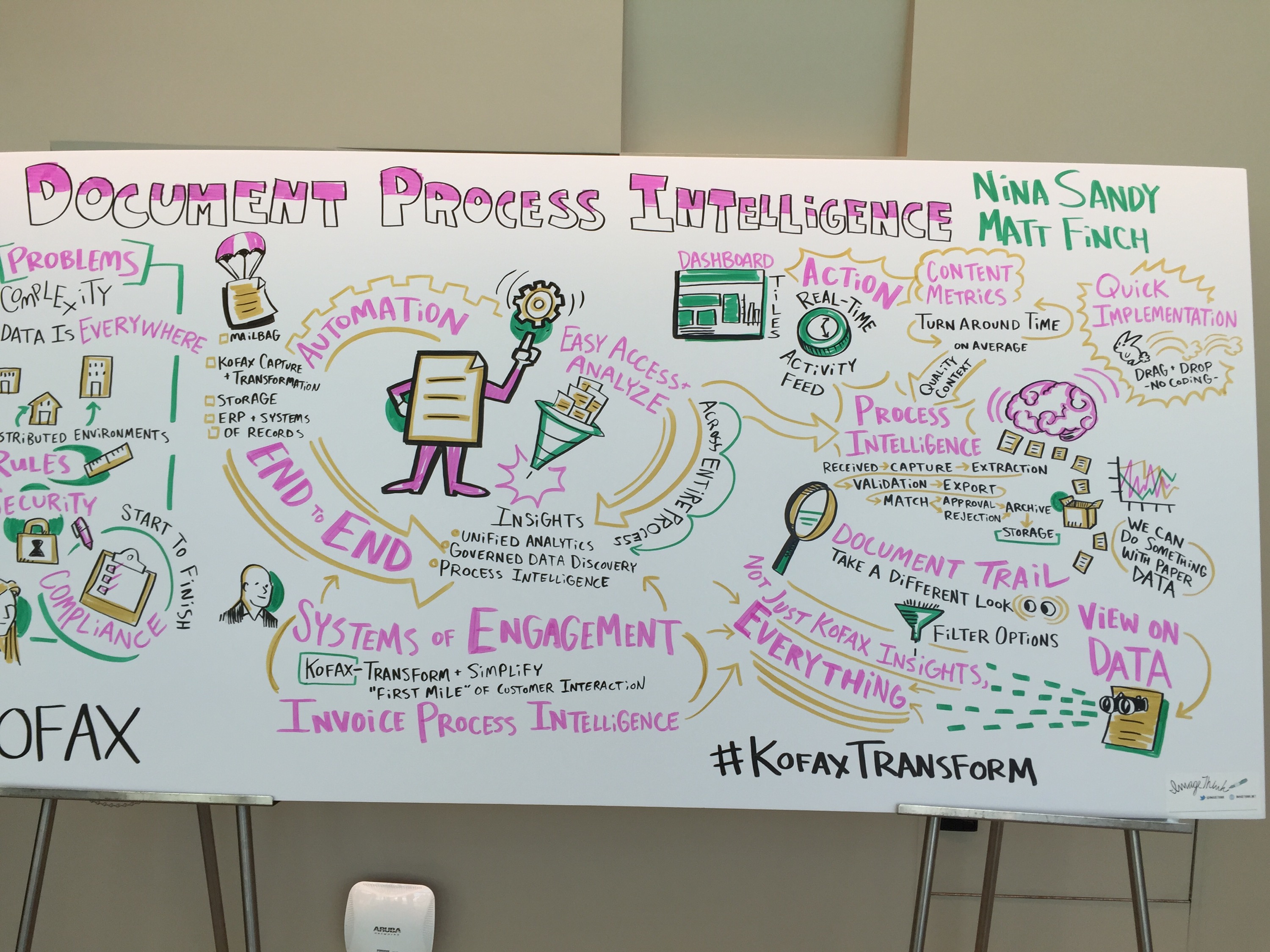

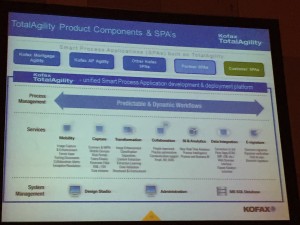

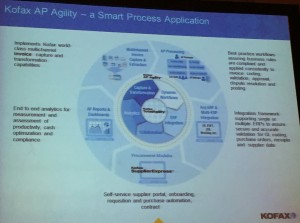

Macciola referred to their platform as BPM — I always have a bit of trouble categorizing it, and tagged my earlier post with both ACM and capture — but also is using the “digital transaction management” terminology that we heard from Bish in this morning’s keynote, which includes inbound content processing (mobile, web, multi-channel, transformation), process orchestration (dynamic case management), process intelligence, information integration, and outbound customer communications management (content creation, e-signature and signature verification).

This was followed by a presentation by Thomas Knapp, SVP/CIO of Waterstone Mortgage, on how they are planning to use Kofax Mortgage Agility integrated with their Ellie Mae mortgage origination system, providing both the branch employee and customer experience. There are a lot of challenges with mortgage origination, in terms of data completeness and quality, customer experience and time sensitivity due to purchase closing deadlines. In the US, due to the involvement of mortgage-based securities in the financial meltdown a few years ago, there are a lot of new compliance rules that Waterstone needs to enforce along the way. They are also dealing with the rise of millennials in the generation of borrowers and their familiarity with technology (although there are many of us who are a lot older who also want an online, paperless experience), and need to have a consistent online experience for the entire mortgage lifecycle, not just origination. They are a “lighthouse” (early/beta) client for Mortgage Agility, and are just launching a beta version of their application this month, with a full rollout later in 2015; they are seeing challenges with the branch employees and their comfort with the technology as well as the technology itself. However, they expect this to be a true game changer for them, increasing operational efficiencies, saving time, boosting productivity, minimizing costs, and identifying opportunities for improvements and increased revenues. He summarized their expected benefits in terms of market, technology, loan process flow and compliance, with a great deal of automation as well as improving the customer experience. Good plans, although it will be critical to see the success of their rollout as it occurs.

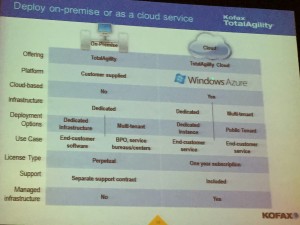

We finished up the analyst briefing with a panel of Kofax executives: Reynolds Bish (CEO), Jamie Arnold (CFO), Howard Dratler (EVP sales) and Grant Johnson (CMO). From the Q&A, it’s clear that TotalAgility is still in the early stages of rollout to actual production environments with customers and partners, and their license deal for KTA discussed in this morning’s keynote is a way to nudge customers towards it. This will be a factor in Kofax’s success, since long-term support of the legacy products will eventually become a drag on technology resources and impact revenue and productivity. There was quite a bit of discussion about new sales teams and partner programs to better sell KTA as well as sales of some of the acquired products that are still offered on a standalone basis; as with other vendors, they are always looking to shorten the sales cycle as well as grow the sales pipeline based on the enhanced product portfolio. They are also actively working to expand their customer base beyond financial services, which has been their mainstay, although they continue to focus on banking as a key vertical with lots of opportunities for expansion within current customers with their mobile, e-signature and customer communication management products. Netflix is one of their high-profile customers in a new market segment, although it appears that they are relying primarily on their partner channel for approaching other verticals. In response to a question about cloud strategy, Bish stated that they see limited demand for (public) cloud because of the nature of the data being transmitted, which delayed the first cloud version of KTA to less than a year ago; although they have a bit of cloud exposure through their Kapow acquisition, they’ve been slow to market on this. They are seeing some demand from smaller companies that can’t afford the on-premise infrastructure, plus some incremental (rather than replacement) use cases within their existing large customer base for rolling out solutions more quickly than can be done internally.

We break for lunch now, and I have some spare time to hit a couple of the regular breakout sessions (or the pool) before a CEO roundtable later this afternoon.