This might be the only breakout session that I make it to today, since I’m in an executive Q&A after this, then need a bit of time for final preparations for my own session later this afternoon. The insurance industry session was presented by Richard Medina of Doculabs, with the title “Don’t Just Survive – Thrive”, a phrase that I used quite a bit in talking about digital business during the pandemic era to stress that it’s not just about doing the minimum possible to survive, but leverage the new technologies and methods to go far beyond that and become a market leader. Here, he was specifically talking about digital insurance operations, which is coincidentally the use case that I will cover in my presentation is about insurance claims.

He started with a slide defining intelligent automation, specifically referencing workflow (process orchestration), RPA, intelligent document processing, natural language processing, and process mining, since these are the specific technologies that Doculabs covers. There was quite a bit on their market and methods, but he came back to a key point for those in the audience: a lot of organizations didn’t consider content management as a real part of digital transformation. So wrong. In applications like insurance claims, content is core to the process: the entire process of handling a claim is based on populating the claims file with all of the necessary documentation to support the claim decision. It doesn’t mean that all of this content is on paper any more, or even ever exists on paper within the organization: forms are created online and e-signed, spreadsheets are used to document a full statement of loss, and policyholders upload images related to their claim. This is, of course, not the same as claims operations of old, where everything was on paper in huge file folders, occasionally with the addition of a CD that holds some photos of damage, although those were often printed for the file. E-mails would be printed out and added to the paper folder.

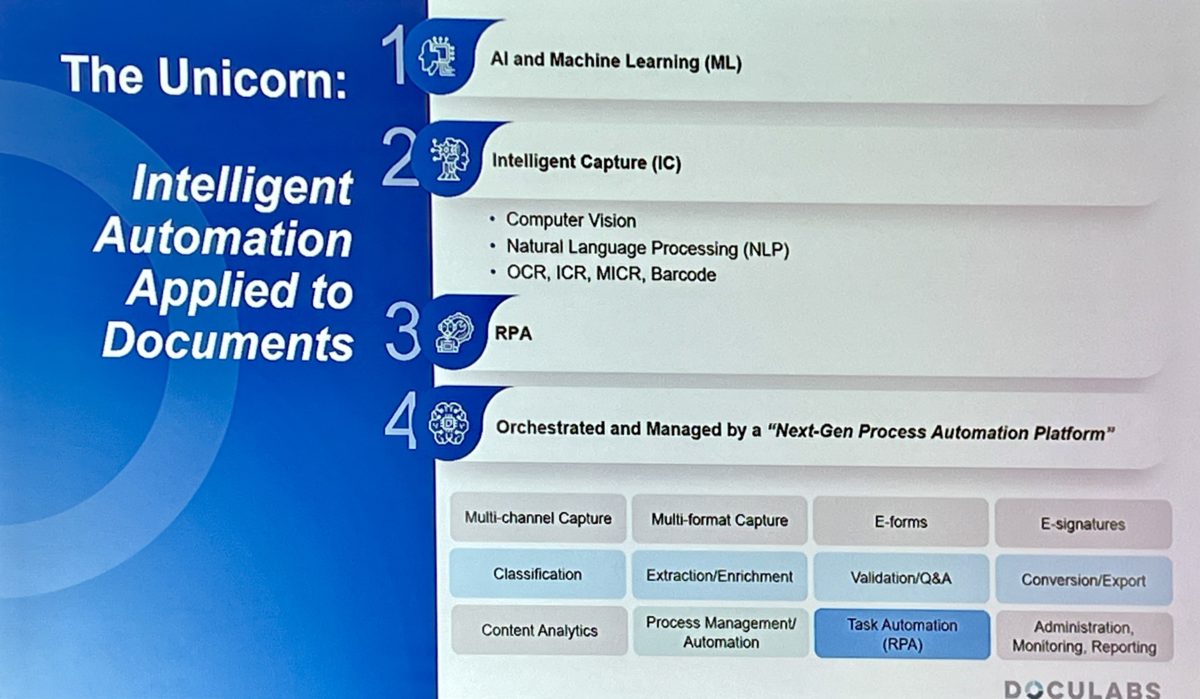

This brings some challenges to insurance operations, particularly claims where there may be rich media involved. Not only do paper and possibly multiple online document repositories need to be consolidated (via merging or federation), but they also need to include other types of unstructured content: photos, videos, social media conversations, and more. The core content engine(s) needs to support all of this, but there’s much more: it needs to be cloud-based for today’s remote workforce, include NLP and AI during intelligent capture for automatic content classification and extraction, have process automation to move the content through its lifecycle and integrate with line-of-business systems, and include chatbots for simpler interactions with policyholders. Medina talked about the unicorn of intelligent automation applied to documents: AI/ML, intelligent capture, RPA, and BPM (orchestration). He walked through a couple of scenarios on policy administration, servicing and claims, showing how different technologies come into play at each point in these processes.

He showed some of the issues to consider for different levels of transformation at each stage in a potential roadmap, starting with content ingestion (capturing content, automating completion checklists, and integrating the content with the LOB systems), then workflow. He finished up with a bit on process mining to show how it can be used to introspect your current processes, do some root cause analysis, and optimize the process. A flying tour through how many of the technologies being discussed here this week can be applied in insurance applications.

If you’re interested in some of the best practices around projects involving these technologies, check out my presentation at 4:45pm today on maximizing success in business automation projects.