When I write a present about the type of digital transformation that the pandemic is forcing on firms in order to survive, I usually use examples from financial services and insurance, since that’s where I do most of my consulting. However, we see examples all around us as consumers, as every business of every size struggles to transform to an online model to be able to continue providing us with goods and services. And once both the consumers and the businesses see the benefits of doing some (not all) transactions online, there will be no going back to the old way of doing things.

I recently moved, and just completed the closing on the sale of my previous home. It’s been quite a while since I last did this, but it was always (and I believe still was until a few months ago) a very paper-driven, personal service type of transaction. This time was much easier, and almost all online; in fact, I’ve never even met anyone from my lawyer’s office face-to-face, I didn’t use a document courier, and I only saw my real estate agent in person once. All documents were digitally signed, and I had a video call with my lawyer me to walk through the documents and verify that it was me doing the signing. I downloaded the signed documents directly, although the law office would have been happy to charge me to print and mail a copy. To hand over the keys, my real estate agent just left their lockbox (which contained the keys for other agents to do showings) and gave the code to my lawyer to pass on to the other party once the deal was closed. Payments were all done as electronic transfers.

My lawyer’s firm is obviously still struggling with this paradigm, and provided the option to deliver paper documents, payments and keys by courier (in fact, I had to remind them to remove the courier fee from their standard invoice). In fact, they no longer offer in-person meetings: it has to be a video call. Yes, you can still sign physical documents and courier them back and forth, but that’s going to add a couple of days to the process and is more cumbersome than signing them digitally. Soon, I expect to see pricing from law firms that strongly encourages their clients to do everything digitally, since it costs them more to handle the paper documents and can create health risks for their employees.

Having gone through a real estate closing once from the comfort of my own home, I am left with one question: why would we ever go back to the old way of doing this? I understand that there are consumers who won’t or can’t adopt to new online methods of doing business with organizations, but those are becoming fewer every day. That’s not because the millennial demographic is taking over, but because people of all ages are learning that some of the online methods are better for them as well as the companies that they deal with.

Generalizing from my personal anecdote, this is happening in many businesses now: they are making the move to online business models in response to the pandemic, then finding that for many operations, this is a much better way of doing things. Along the way, they may also be automating some processes or eliminating manual tasks, like my lawyer’s office eliminating the document handling steps that used to be done. Not just more efficient for the company, but better for the clients.

As you adjust your business to compensate for the pandemic, design your customer-facing processes so that they make it easier (if possible) for your customer to do things online than the old way of doing things. That will almost always be more efficient for your business, and can greatly improve customer satisfaction. This does not mean that you don’t need people in your organization, or that your customers can’t talk to someone when required: automating processes and tasks means that you’re freeing up people to focus on resolving problems and improving customer communications, rather than performing routine tasks.

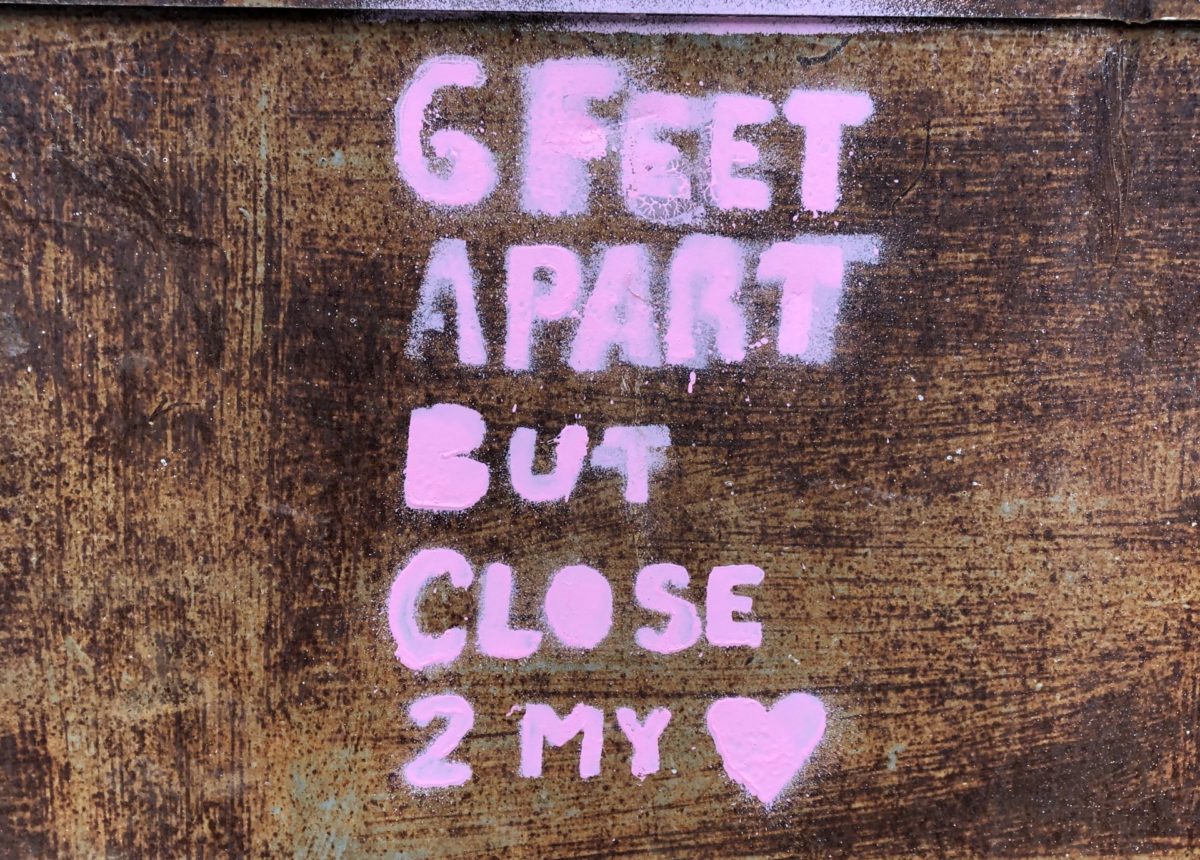

As one of my neighbourhood graffiti artists so eloquently put it, “6 feet apart but close 2 my ❤”.