Trisotech and their partner Lux Magi held a webinar today on the role of decision modeling and management in financial services firms. Jan Purchase of Lux Magi, co-author (with James Taylor) of Real-World Decision Modeling with DMN, gave us a look at why decision management is important for financial services. One of the key places for applying decision management is in compliance, which is all about decision-making: assessing risks, applying regulations, sharing data, and ensuring that rules are applied in a uniform manner. There are a lot of other areas where decision management can be applied, and potentially automated where this is a high volume/speed of transactions with a non-zero cost of errors. Decision management lets you make decisions explicit: it separates them from other business software to increase transparency and agility, and makes it easier for business people to understand what decisions are being applied and how that links to overall business goals. In particular, if decisions are automated with a decision management system, business people can quickly make changes to decision-making when compliance regulations change, with a much smaller IT involvement that would be required to modify legacy business systems.

There is a great deal of value in modeling decisions even if they are embedded within business systems and won’t be automated using a decision management system: decision models provide a way for business people to specify how systems should behave based on business data. Luckily, there is now a standard for decision modeling: Decision Model and Notation (DMN). This notation allows a decision to be modeled as a Decision Requirements Diagram (DRD) of the sub-decisions and knowledge sources that are required to reach that decision, and the possible paths to take in order to reach the decision. Within each of the decision nodes in the DRD, a definition of the decision can be specified using a decision table or the Friendly Enough Expression Language (FEEL), which may then be linked to an automated decision management system.

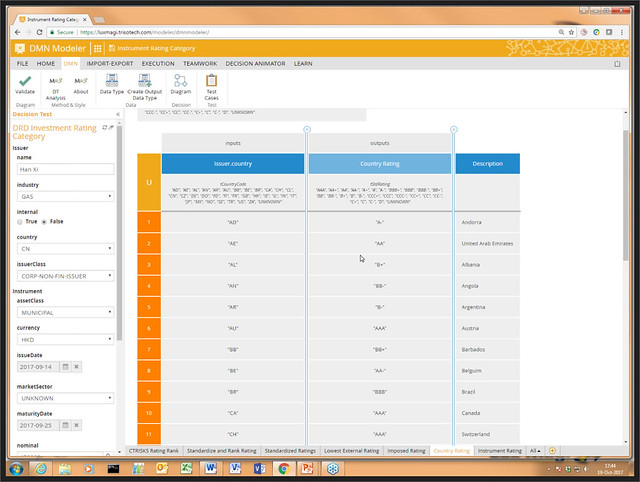

We then saw what a decision model looks like in Trisotech’s DMN Modeler, which allows for a standard DRD to be created, then augmented with additional information such as decision makers and owners. Purchase walked us through a number of the features of DMN as well as specific features of Trisotech’s tool, including analysis of decisions relative to Bruce Silver’s Method and Style best practices, and decision animation.

If you know a bit about DMN already but want to understand some of the practical aspects of working with it in financial services, I assume that a replay of the webinar will be available at the original registration link or the Lux Magi event page.

Thanks Sandy. As usual your blog posts are timely and leading edge.

Dan