Lynn Elwood, VP Cloud and Services from OpenText, hosted a panel on FinTech to close out the morning at the ITWC digital transformation conference in Toronto. She started with some background on digital transformation in financial services, where there is still a strong focus on cost reduction, but customer engagement has become more important. She included survey results with a somewhat disappointing view on paperless offices, with more than 75% of the respondents saying that they would not be going paperless for as much as five years or maybe never. Never??!! Maybe just not within the career lifetime of the respondents, but c’mon, never? I understand that digital transformation is not the same as content digitization, but if you’re still running on paper, that’s just going to fundamentally limit the degree of your transformation.

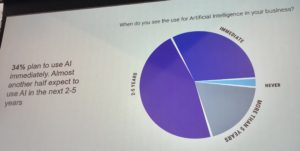

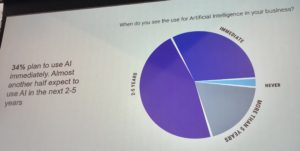

Lynn Elwood, VP Cloud and Services from OpenText, hosted a panel on FinTech to close out the morning at the ITWC digital transformation conference in Toronto. She started with some background on digital transformation in financial services, where there is still a strong focus on cost reduction, but customer engagement has become more important. She included survey results with a somewhat disappointing view on paperless offices, with more than 75% of the respondents saying that they would not be going paperless for as much as five years or maybe never. Never??!! Maybe just not within the career lifetime of the respondents, but c’mon, never? I understand that digital transformation is not the same as content digitization, but if you’re still running on paper, that’s just going to fundamentally limit the degree of your transformation.  At the same time, more than 75% were saying that they plan to use AI already or within the short term (hopefully to replace the people who think that they’re never going to be paperless), and most organizations said that they were equal or better than their peers in digital transformation (statistically unlikely). Unintentionally hilarious.

At the same time, more than 75% were saying that they plan to use AI already or within the short term (hopefully to replace the people who think that they’re never going to be paperless), and most organizations said that they were equal or better than their peers in digital transformation (statistically unlikely). Unintentionally hilarious.

The panel was made up of Michael Ball, CISO Advisor for a number of firms including Freedom Mobile; Amer Matar, CTO of Moneris (a large Canadian payment processor); and Patrick Vice, partner at Insurance-Canada.ca (an industry organization for P&C insurance). Matar talked about how legacy technology holds back companies: existing companies have the advantage of being established incumbents, but newer players (e.g., Square in the payments market) can enter with a completely new business model and no legacy customers or infrastructure to drag along. Vice talked about how companies can combat this by spinning off separate business units to provide a more streamlined digital experience and brand, such as how Economical Insurance did with Sonnet (a project that I had the pleasure of working on last year), which still uses the established insurance organization behind a modern customer experience. Ball stressed that the legacy systems are evolving at a much slower rate than is required for digital transformation, and the new front ends need to go beyond just putting a friendly UI on the old technology: they need to incorporate new services to present a transformed customer experience.

The panel was made up of Michael Ball, CISO Advisor for a number of firms including Freedom Mobile; Amer Matar, CTO of Moneris (a large Canadian payment processor); and Patrick Vice, partner at Insurance-Canada.ca (an industry organization for P&C insurance). Matar talked about how legacy technology holds back companies: existing companies have the advantage of being established incumbents, but newer players (e.g., Square in the payments market) can enter with a completely new business model and no legacy customers or infrastructure to drag along. Vice talked about how companies can combat this by spinning off separate business units to provide a more streamlined digital experience and brand, such as how Economical Insurance did with Sonnet (a project that I had the pleasure of working on last year), which still uses the established insurance organization behind a modern customer experience. Ball stressed that the legacy systems are evolving at a much slower rate than is required for digital transformation, and the new front ends need to go beyond just putting a friendly UI on the old technology: they need to incorporate new services to present a transformed customer experience.

They had an interesting discussion about security, and how moving to digital business models means that companies need to offer a more secure environment for customers. Many people are starting to look at security (such as two-factor authentication) as a competitive differentiator when they are selecting service providers, and while most people wouldn’t now change their bank just because it didn’t provide 2FA, it won’t be long before that is a decision point. It’s not just about cloud versus on-premise, although there are concerns about hosting Canadian customers’ financial data outside Canada, where financial laws (and government access to data) may be different; it’s about an organization’s ability to assure their customer that their information won’t be improperly accessed while offering a highly secure customer-facing portal. There’s a huge spend on security these days, but that needs to settle down as this becomes just baked into the infrastructure rather than an emergency add-on to existing (insecure) systems.

Good discussion, although it points out that it’s still early days for digital transformation in financial services.