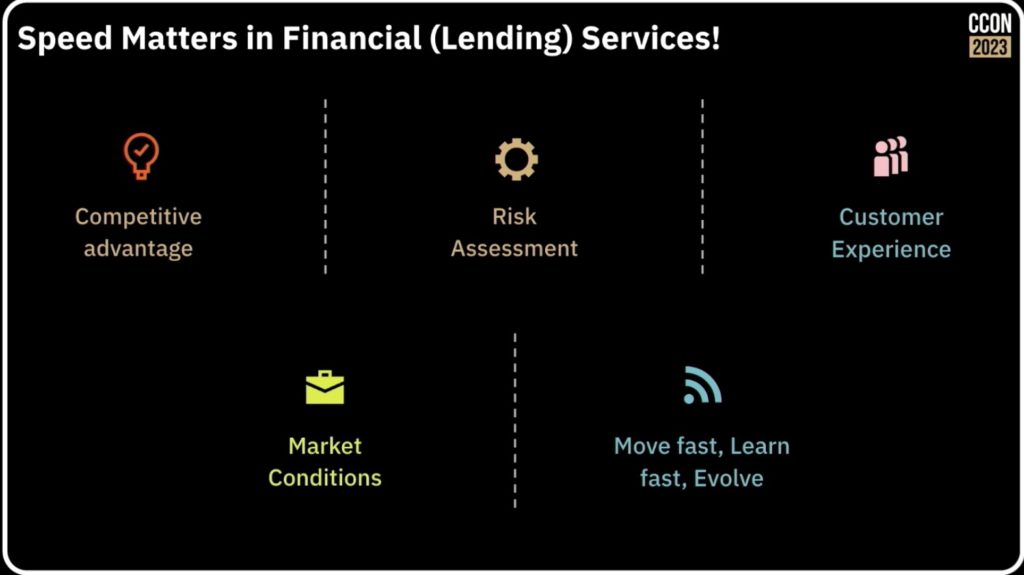

Rajesh Kumar Dharmalingam of Funding Societies Pte Ltd, a Singapore-based fintech startup, shared the story of their automated processes for instant loan approval. They provide (typically unsecured) financing to small and medium enterprises in Southeast Asia, from micro loans to much larger term loans, a total of about $1B USD per year. One key to their success is near-instant loan approval with manual intervention only for exceptions, while still successfully managing loan risk.

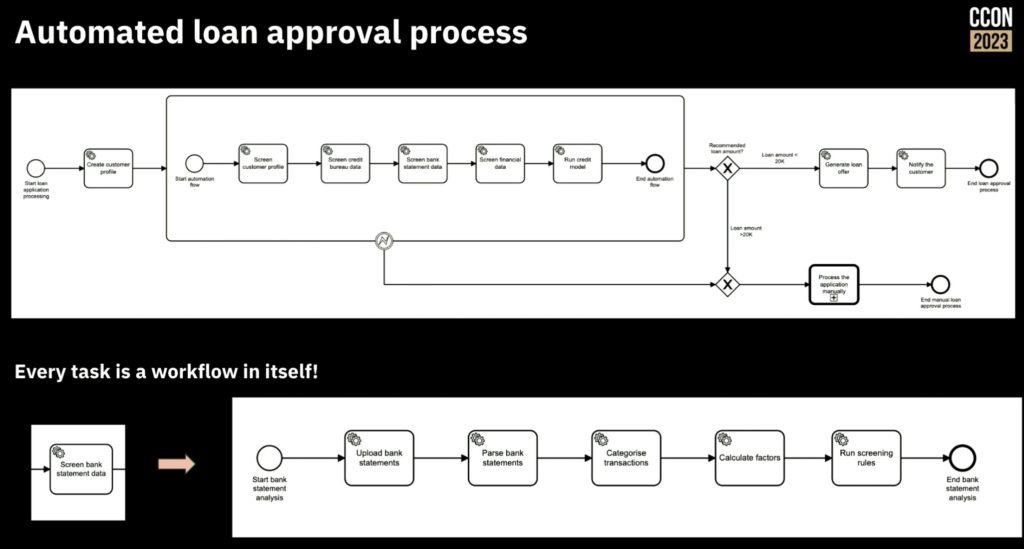

Loan approval processes are pretty much the same everywhere: collect information about the client, gather and assess financial information and risk, determine the allowable loan amount, and provide funding to the client. Funding Societies has a relatively straightforward loan approval process, but it includes a number of more complex tasks and decisions to assess risk.

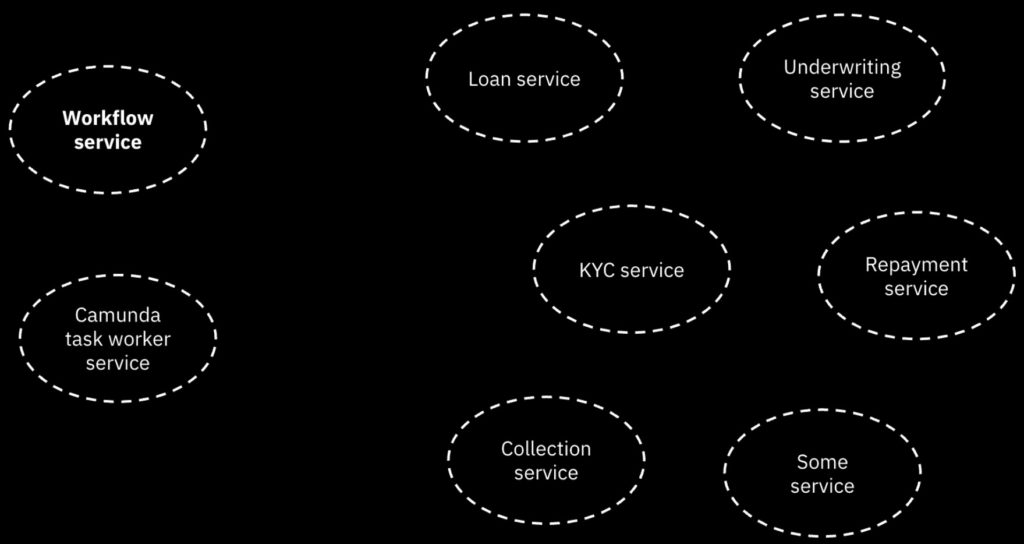

They have deployed Camunda as a microservice (in AWS cloud) as a peer to many other microservices that they use, which gives them quite a bit of flexibility and scalability.

Rajesh credits Camunda with helping him understand the value of rules/decision management, which they ended up relying on quite a bit: there are different sets rules for different countries and loan types, and rules are used for many of the decisions with the process flow. They design their processes with subprocesses for reusability in order to avoid monolithic processes, although that has been a journey for them; he advises just getting started first, then refactor the processes later. They don’t use the Camunda tasklist, but build all of their UI in Angular — this is a common approach for more technical development shops that are integrating Camunda into a much broader platform. Lots of interest from the audience in questions, since “instant” and “automated” are what everyone wants to see in their loan processes.