First session of the afternoon on the first day of bpmNEXT 2018, and this entire section is on DMN (decision management notation) and the requirement for decision automation based on DMN.

Decision as a Service (DaaS): The DMN Platform Revolution, Trisotech

Denis Gagne of Trisotech, who knows as much about DMN and other related standards as anyone around, started off the session with his ideas on the need for decision automation driven by requirements such as GDPR. He walked through their suite of decision-related products that can be used to create decision services to be consumed by other applications, as well as their conformance to the DMN standards. His demo showed a decision model for determining the best price to offer a rental vehicle customer, and walked through the capabilities of their platform with this model: DMN style check, import/export, execution, team collaboration, and governance through versioning. He also showed how decision models can be reused, so that elements from one model can be used in another model. Then, he showed how to take portions of the model and define them as a service using a visual wrapper, much like a subprocess wrapper visualization in BPMN, where the relationship lines that cross the service boundary become the inputs and outputs to the service. Cool. The service can then be deployed as an executable service using (in his demo) the Red Hat platform, test its execution using from a generated HTML form, generate the REST API or Open API interface code, run predefined test cases based on DMN TCK, promote the service from test to production, and publish it to an API publisher platform such as WSO2 for public consumption. The execution environment includes debugging and audit logs, providing traceability on the decision services.

Timing the Stock Market with DMN, Bruce Silver Associates

Bruce Silver, also a huge contributor to BPMN and DMN standards, and author of the BPMN Method & Style books and now the DMN M&S, presented an application for buying a stock at the right time based on price patterns. For investors who time the market based the pricing, the best way to do this is to look at daily min/max trends and fit them to one of several base type models. Bruce figured that this could be done with a decision table applied to a manipulated version of the data, and automated this for a range of stocks using a one-year history, processing in Excel, and decision services in the Trisotech cloud. This is a practical example of using decision services in a low-code environment by non-programmers to do something useful. His demo showed us the decision model for doing this, then the data processing (smoothing) done in Excel. However, for an application that you want to run every day, you’re probably not going to want to do the manual import/export of data, so he showed how to automate/orchestrate this with Microsoft Flow, which can still use the Excel sheet for data manipulation but automate the data import, execute the decision service, and publish the results back to the same Excel file. Good demonstration of the democratization of creating decisioning applications by through easy-to-use tools such as the graphical DMN modeler, Excel and Flow, highlighting that DMN is an execution language as well as a requirement language. Bruce has also just published a new book, DMN Cookbook, co-authored with Edson Tirelli of Red Hat, on getting started DMN business implementations using lightweight stateless decision services called via REST APIs.

Bruce Silver, also a huge contributor to BPMN and DMN standards, and author of the BPMN Method & Style books and now the DMN M&S, presented an application for buying a stock at the right time based on price patterns. For investors who time the market based the pricing, the best way to do this is to look at daily min/max trends and fit them to one of several base type models. Bruce figured that this could be done with a decision table applied to a manipulated version of the data, and automated this for a range of stocks using a one-year history, processing in Excel, and decision services in the Trisotech cloud. This is a practical example of using decision services in a low-code environment by non-programmers to do something useful. His demo showed us the decision model for doing this, then the data processing (smoothing) done in Excel. However, for an application that you want to run every day, you’re probably not going to want to do the manual import/export of data, so he showed how to automate/orchestrate this with Microsoft Flow, which can still use the Excel sheet for data manipulation but automate the data import, execute the decision service, and publish the results back to the same Excel file. Good demonstration of the democratization of creating decisioning applications by through easy-to-use tools such as the graphical DMN modeler, Excel and Flow, highlighting that DMN is an execution language as well as a requirement language. Bruce has also just published a new book, DMN Cookbook, co-authored with Edson Tirelli of Red Hat, on getting started DMN business implementations using lightweight stateless decision services called via REST APIs.

Smarter Contracts with DMN, Red Hat

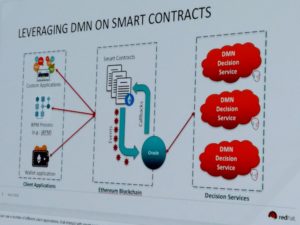

Edson Tirelli of Red Hat, Bruce Silver’s co-author on the above-mentioned DMN Cookbook, finished this section of DMN presentations with a combination of blockchain and DMN, where DMN is used to define the business language for calculations within a smart contract. His demo showed a smart land registry case, specifically a transaction for selling a property involving a seller, a buyer and a settlement service created in DMN that calculates taxes and insurance, with the purchase being executed using cryptocurrency. He mentioned Vanessa Bridge’s demo from earlier today, which showed using BPMN to define smart contract flows; this adds another dimension to the same problem, and likely no reason why you wouldn’t use them all together given the right situation. Edson said that he was inspired, in part, by this post on smart contracts by Paul Lachance, in which Lachance said “a visual model such as a BPMN and/or DMN diagram could be used to generate the contract source code via a process-engine”. He used Ethereum for the blockchain smart contract and the Ether cryptocurrency, Trisotech for the DMN models, and Drools for the rules execution. All in all, not such a far-fetched idea.

Edson Tirelli of Red Hat, Bruce Silver’s co-author on the above-mentioned DMN Cookbook, finished this section of DMN presentations with a combination of blockchain and DMN, where DMN is used to define the business language for calculations within a smart contract. His demo showed a smart land registry case, specifically a transaction for selling a property involving a seller, a buyer and a settlement service created in DMN that calculates taxes and insurance, with the purchase being executed using cryptocurrency. He mentioned Vanessa Bridge’s demo from earlier today, which showed using BPMN to define smart contract flows; this adds another dimension to the same problem, and likely no reason why you wouldn’t use them all together given the right situation. Edson said that he was inspired, in part, by this post on smart contracts by Paul Lachance, in which Lachance said “a visual model such as a BPMN and/or DMN diagram could be used to generate the contract source code via a process-engine”. He used Ethereum for the blockchain smart contract and the Ether cryptocurrency, Trisotech for the DMN models, and Drools for the rules execution. All in all, not such a far-fetched idea.

I’m still catching flak for suggesting the now-ubiquitous Ignite style for presentations here at bpmNEXT; my next lobbying effort will be around restricting the maximum number of words per slide. 🙂